Retrace

Python, Quant Finance, Time Series, SMC / Market Structure

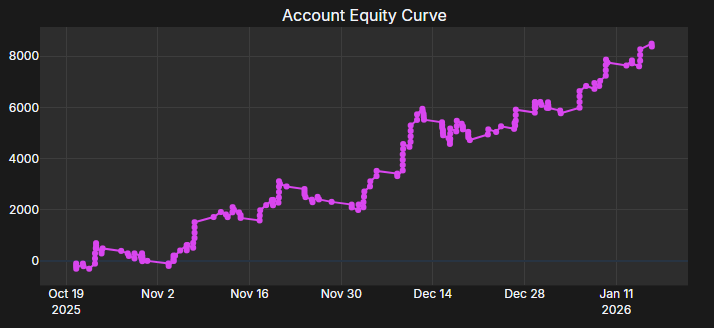

Retrace is a personal quantitative trading and market analysis project I built to explore financial data analytics by converting institutional-style price action concepts into a repeatable, testable system.

The project is currently implemented in Python as a proof of concept, prioritising research speed, clarity, and analytical flexibility over low-latency execution.

Strategy Architecture

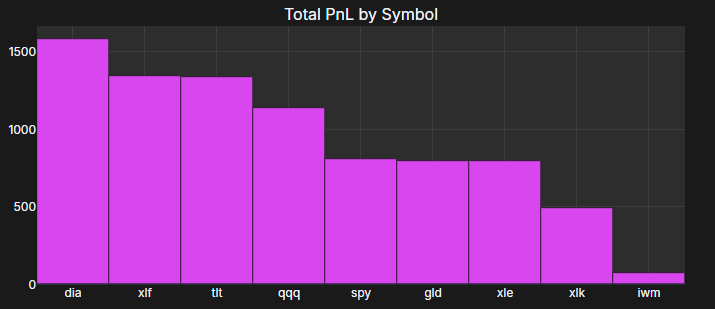

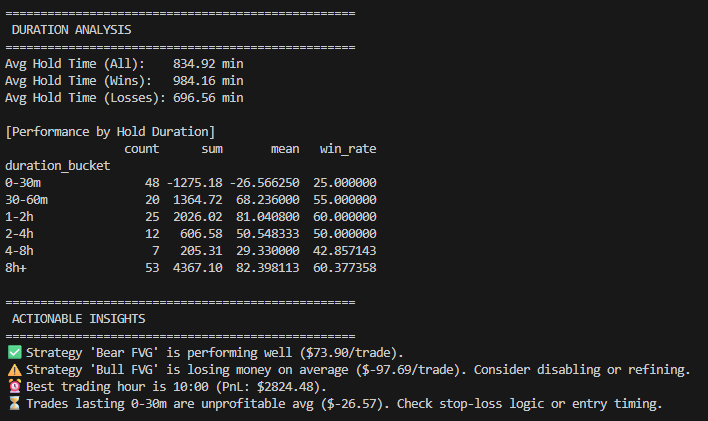

At its core, Retrace is a rule-based Smart Money Concept (SMC) expert system. Instead of machine learning, the engine uses a strict logic tree to model market structure, liquidity, and displacement, allowing me to study how discretionary trading concepts can be expressed programmatically.

The system focuses on retracement-based execution, placing limit orders at areas of imbalance rather than reacting to momentum or chasing price.

Data & Feature Engineering

The feature engineering layer derives all decision inputs from raw price data, including trend regime classification using the 200 EMA, structural swing detection via fractals, volatility-adjusted displacement analysis, and fair value gap (FVG) imbalance identification.

Decision Logic & Risk Management

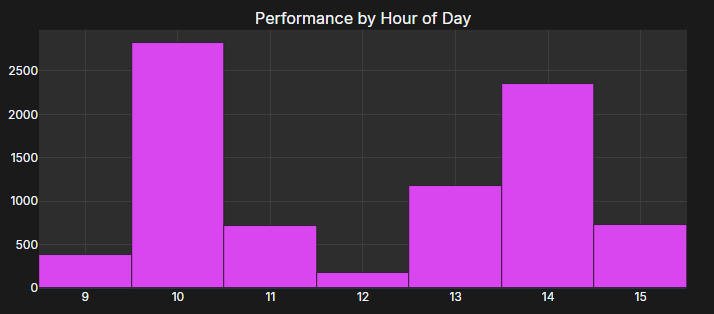

Signals pass through a staged gatekeeper process that enforces trend alignment, premium/discount location, and a quality-scored trigger before any trade is permitted. Risk is managed systematically through volatility-aware stops and dynamic targets.

Current State & Roadmap

Retrace currently operates on historical market data for analysis and iteration. A key next step is integrating real-time data, followed by migrating performance-critical components to a faster language as the system evolves.

Longer term, I plan to incorporate machine learning for fundamental context, allowing the engine to account for macro events, earnings, and news-driven risk without replacing the deterministic execution logic.

Overall, Retrace serves as my platform for learning financial data analytics, systematic strategy design, and production-oriented trading architecture.

Python

Proof of Concept

Rule-Based

SMC Logic Tree

Historical

Research & Backtesting

Roadmap

Real-Time + Faster Language

Rule-based SMC expert system built as a learning project in financial data analytics, designed to convert discretionary structure concepts into repeatable, testable logic.

Feature engineering layer that derives market regime and structure signals: 200 EMA trend state, fractal swing points, ATR-adjusted displacement detection, and fair value gap (FVG) imbalance zones confirmed with momentum.

Multi-stage decision engine: trend alignment + premium/discount location filtering, then an FVG trigger that must pass a quality score (structure confluence, EMA overlap, liquidity sweep behaviour, and market activity checks).

Systematic execution + risk management: limit entries at FVG boundaries, stops beyond the gap with ATR buffer, and dynamic targets adjusted for volatility conditions and nearby liquidity.

Roadmap-focused architecture: moving from historical research toward real-time data processing, and eventually migrating performance critical parts to a faster language for lower latency and improved throughput.

Planned ML extension for fundamental context: adding news/event awareness (earnings, macro releases, sentiment) to adjust confidence and risk during high-impact periods without replacing the rules-based execution engine.